What is ETH Strategy

Introduction to the ETH Strategy Protocol

What is ETH Strategy?

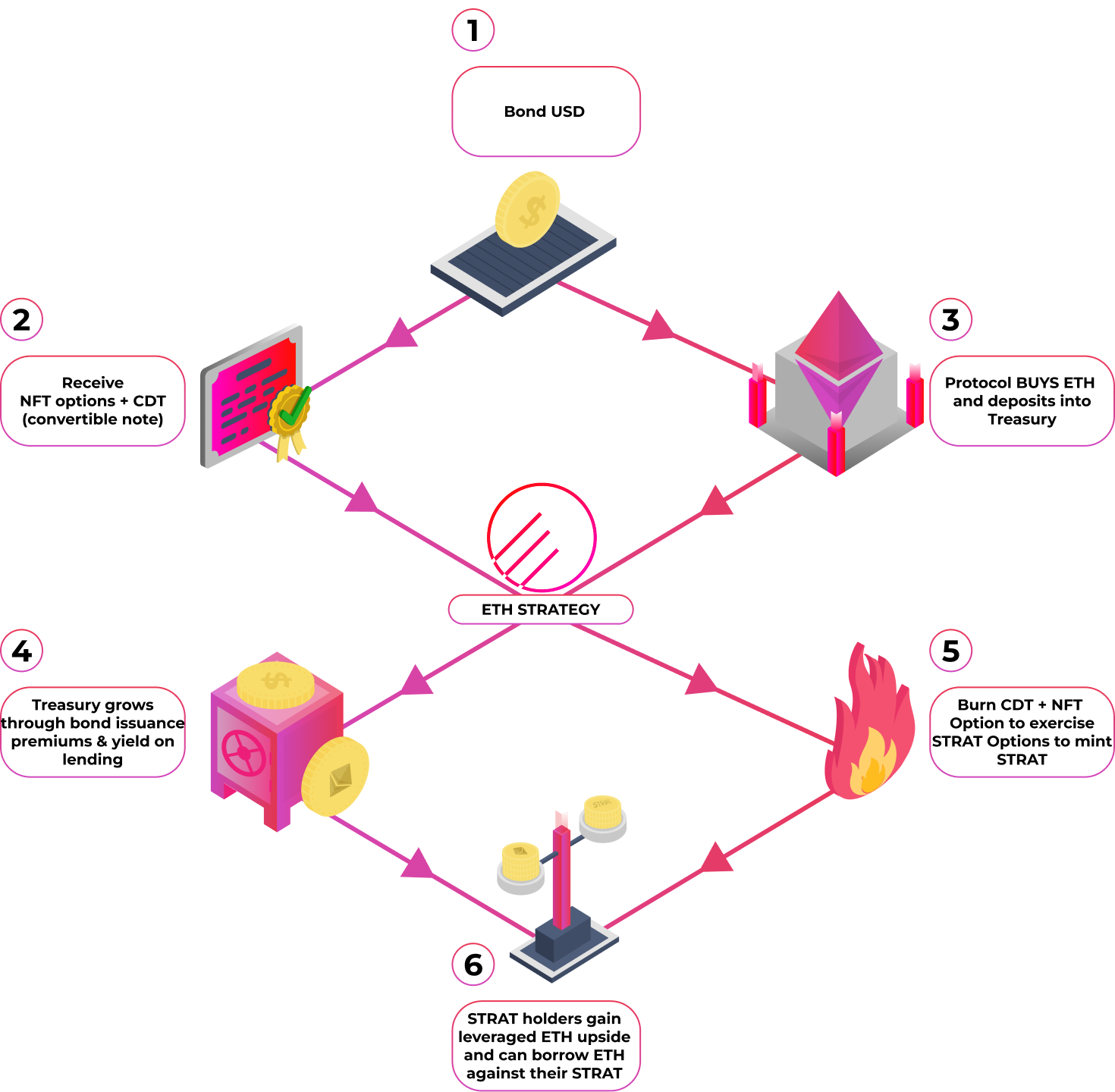

ETH Strategy is a treasury accumulation protocol designed to provide leveraged exposure to Ethereum (ETH) without the traditional risks associated with margin liquidations or volatility decay.

The protocol innovates traditional convertible notes into a new defi primitive, by separating the long-dated debt and the attached conversion optionality. This re-imagines the "MSTR Trade" within a composable decentralized environment.

The end product is the token, STRAT, which is accretive to ETH, providing enhanced returns for both crypto natives and new entrants seeking higher-beta exposure to ETH, securely and transparently on-chain.

Why is ETH Strategy needed?

Ethereum (ETH) remains one of the largest digital assets by market capitalization, backed by extensive liquidity and robust DeFi infrastructure. Yet, despite its prominence, investors seeking higher-beta returns often overlook or under-allocate to ETH, focusing on smaller-cap, higher-beta assets for greater upside potential.

Traditional leveraged solutions (e.g., perpetual futures and CDP margin lending) expose investors to liquidation risk and high funding costs, while leveraged tokens can suffer from frequent rebalancing (volatility decay). This protocol aims to provide a leveraged proxy to ETH with minimal liquidation and volatility risks, positioning itself as a decentralized analogue to the well-known “MSTR trade”.

Last updated